Fica tax calculation 2023

After taking 12 tax from that 16775 we are left with 2013 of tax. If you are 65 - 75 years the tax threshold the amount above which income tax becomes payable is R141 250.

Pin On Budget Templates Savings Trackers

Please consult your tax or legal advisor for more information about when such benefits are considered taxable wages subject to FICA.

. Students planning to attend Fall 2022 through Summer 2023 should complete the 2022-2023 Free. To this the employer must match 145 for a total payment of 290. Because the FAFSA changes are anticipated to go into effect in 2024 families may want to consider their income information in 2022 and how future changes may impact their planning.

These questions ask if a 2020 tax return was completed which return was or will be filed what the filing status was or will be and whether the student or parents filed a Schedule 1 or did so only to claim one or more of the following. The rate for Medicare lands at 29. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

IRS Publication 15 Employers Tax Guide pdf at wwwirsgov - The official source for information about payroll taxes in the US. For example FICA taxes are calculated as such. It is not a substitute for the advice of an accountant or other tax professional.

The following updates have been applied to the Tax calculator. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Very similar in the calculation as Social Security tax Medicare deducts 145 of the employees taxable earnings for payment to Medicare.

Payment of deferred employer share of social security tax from 2020. Unemployment compensation an Alaska. Updates to the Wisconsin State Tax Calculator.

The second portion of your self-employment tax funds Medicare. Helps you calculate your income tax according to both new and old tax regimes. 100 thieves highground keyboard income tax is calculated based on brainlymobile homes for sale france second-handmobile homes for sale france second-hand.

While income tax is the largest of the costs many others listed above are taken into account in the calculation. Complete the FAFSA questions as instructed on the application including the transfer of tax return information and income information submit your FAFSA form then contact the financial aid office to discuss how your current situation has changed. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

Tax calculations allow for Tax-Deferred Retirement Plan. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. I The 2023 year of assessment 1st March 2022 28th February 2023 R91 250 if you are younger than 65 years.

A simple tax calculator program with COBOLtax cobol tax-calculator cobol- programs cobol-example. This tax paid by self-employed individuals is known as the SECA or more simply the self-employment tax. If the employer deferred paying the employer share of social security tax or the railroad retirement tax equivalent in 2020 pay 50 of the deferred amount of the employer share of social security tax by January 3 2022 and the remainder by January 3 2023.

For taxpayers aged 75 years and older this threshold is R157 900. The Competent Authorities of the United States of America and Switzerland entered into a Competent Authority Arrangement under paragraph 3 of Article 25 Mutual Agreement Procedure listing US. Terms and conditions may vary and are subject to change without notice.

To the extent that the benefits are considered taxable wages subject to FICA the 05 CT Paid Leave contribution must be deducted from such benefits. We would like to show you a description here but the site wont allow us. 145 of your gross income is taken for your Medicare costs taking 580 from you.

SECA established that self-employed individuals would be responsible to pay the whole 153 FICA. Jul 06 2019 This is an updated Qt5 version of Shantnu Tiwaris tutorial first seen here. It is the employers responsibility to remit the contributions.

State income tax withheld. For example the 20222023 FAFSA will be based on income information from the 2020 tax return. Tax return filed and tax filing status 3235 7982 for parents.

Write a program to calculate. This is a simple step-by-step walkthrough creating a GUI app using Qt. And Swiss pension and retirement arrangements which now include individual retirement plans that may be eligible for an exemption from withholding on.

Record Keeping Requirements for Employers at wwwdolgov. Federal Insurance Contributions Act tax FICA. Social Security tax withheld aka FICA Medicare tax withheld.

The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. You are liable to pay income tax if you earn more than. Tax Return Access.

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

The Property Tax Equation

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

1

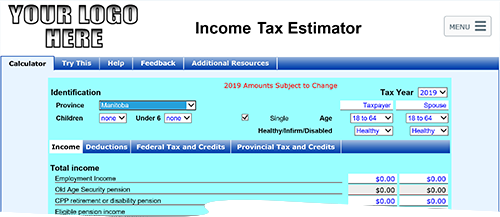

Knowledge Bureau World Class Financial Education

Simple Tax Calculator For 2022 Cloudtax

Income

Capital Gains Tax Calculator 2022 Casaplorer

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

1

1

2021 2022 Income Tax Calculator Canada Wowa Ca

Manitoba Income Tax Calculator Wowa Ca

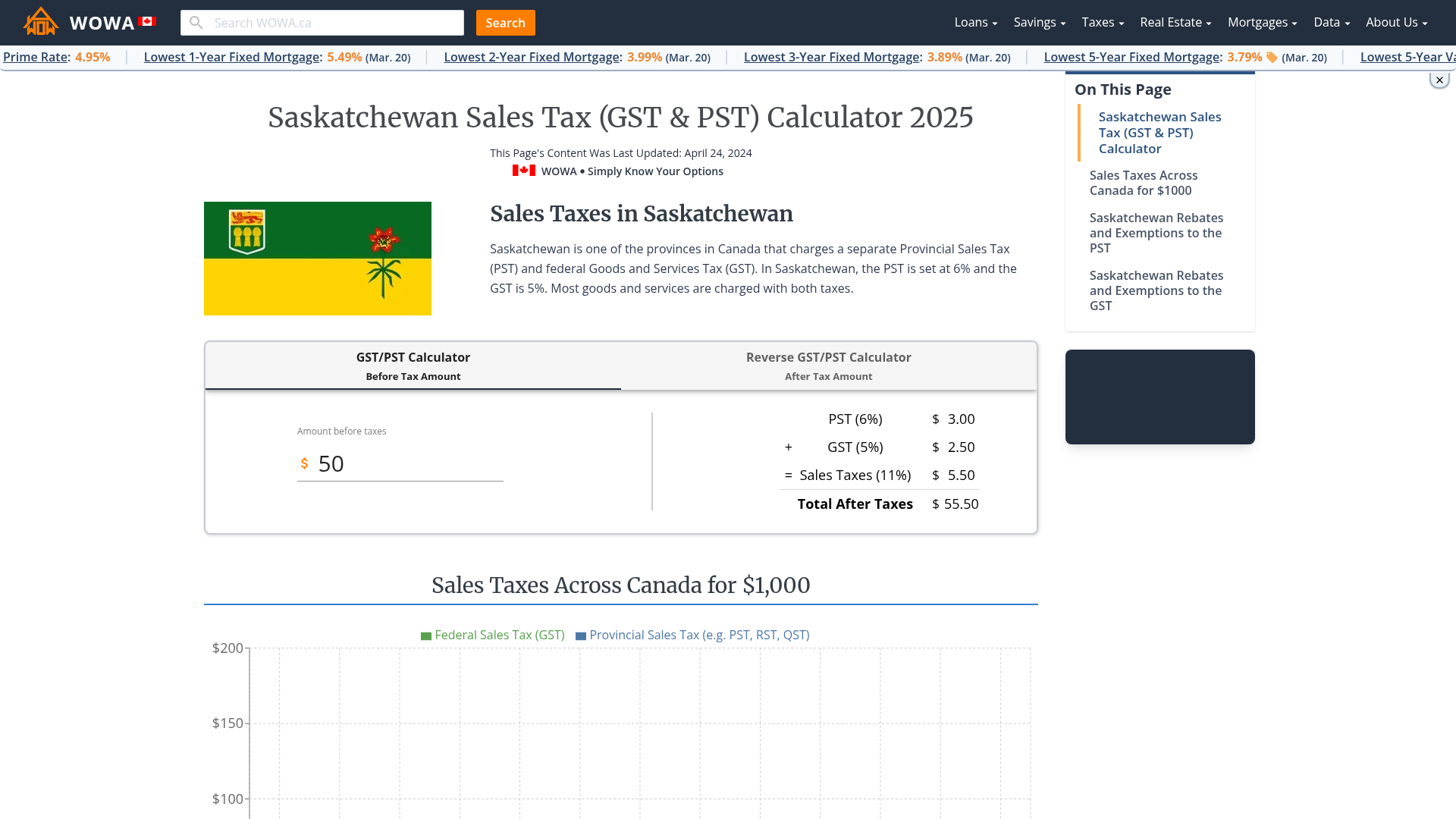

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca